CAC (Customer Acquisition Cost) vs. RoAS (Return on Ad Spend)

Which is more deserving of your attention?

When it comes to acquiring customers, there are two metrics that people turn to in order to judge performance: CAC (sometimes also referred to as CPA) and RoAS (return on ad spend).

People tend to care much more about one than the other. Anecdotally, it seems that this preference is based purely on the marketer’s experience: marketers who worked in the trenches of affiliate digital products tend to prefer CAC, while newer marketers that got their start with Facebook ads tend to prefer RoAS.

I’m going to go through each one’s strengths and weaknesses so that you can determine which you should be leaning on.

CAC = Total Ad Spend / Unique New Customers

CAC is the simpler of the two metrics: it’s the average cost that it takes to acquire a new customer. By itself, CAC says nothing about the customer’s average order value or its lifetime value.

For example, if you spent $1000 in ads and acquired 10 customers, your CAC is $100. It doesn’t matter whether each customer spent $1 or $100. Neil Patel has a pretty good writeup on CAC if you’re interested in more detail.

RoAS = Total Sales / Total Ad Spend

RoAS, on the other hand, takes revenue into account, and you get a nice nifty number that summarizes an ROI of sorts when it comes to ads. If you spend $1000 in ads and get $2000 in sales, then your RoAS is 2.0. While getting $2 for every $1 spent on ads might sound impressive, be careful—depending on what you’re selling, you might actually be losing money (more on that below).

Discussion

It might seem like you should always go with RoAS, given that it’s more robust and incorporates actual sales, right? Not necessarily…

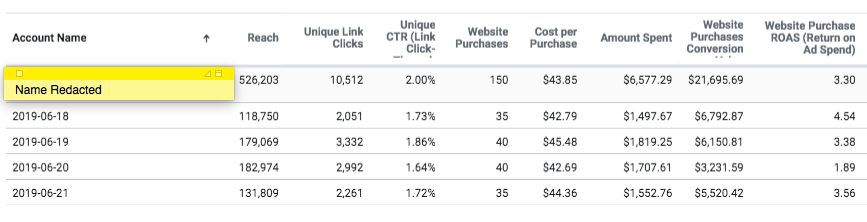

For one, RoAS tends to be a lot more volatile than CAC, because RoAS passes on any volatility in AOV (average order value). For example, here’s a few days of real ad performance from a company that sells products worldwide.

If you were focusing on RoAS instead of CAC, you might think that something went disastrously wrong on 6/20. In reality, all other metrics match up (including the important e-commerce ones not seen, e.g. cost/AddToCart, CPM/CPC, etc.) and the drop in RoAS seems to be from normal statistical randomness.

A lot of people who are focused on COGS (i.e. Cost of Goods Sold) also prefer CAC because it gives them an upper ceiling for what they can spend per customer. This is useful if you are selling one product at one price point. For example, if you are selling a $300 product that takes $100 to product/ship, then you can spend anywhere from $0 to $200 to acquire a customer.

But you can also figure out a similar range of profitability when using RoAS by using the following formula:

Minimum RoAS = 1 / (1 – COGS %)

For example, if your average cost to produce a product is 50%, then you will need a minimum RoAS of (1 / (1-0.5)) or 2.0.

You should always take both metrics into account when possible, but the table below breaks out the different scenarios when you will want to lean on one or the other:

It’s important to make sure you understand the context and you have a good handle on other important e-commerce metrics.